when to expect unemployment tax break refund california

Normally any unemployment compensation someone receives is taxable. The refunds will happen in two waves.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify.

. Congress had waived taxes on the first 10200 of unemployment benefits back in 2020. The first reflects how they filed and the second refund will reflect any tax break they get on their unemployment benefits. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you.

Heres what you need to know. The IRS will issue refunds by direct deposit for taxpayers with valid banking information on their 2020 return. Eligible filers whose tax returns have been processed will receive two refunds.

Taxpayers who filed before March 11 2021 will receive any related refunds beginning in August 2021. Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. The tax waiver led to some confusion given it was announced in the middle of tax season prompting the IRS to offer additional guidance on how to claim iteven.

In addition people who received unemployment benefits in 2021 may be in for a rude awakening in the following year. The IRS anticipates most taxpayers will receive refunds as in past years. COVID Tax Tip 2021-46 April 8 2021.

Links in this document Enlaces en este documento. The IRS announced it will automatically issue refunds for the unemployment tax break. When Should I Expect My Tax Refund In 2022.

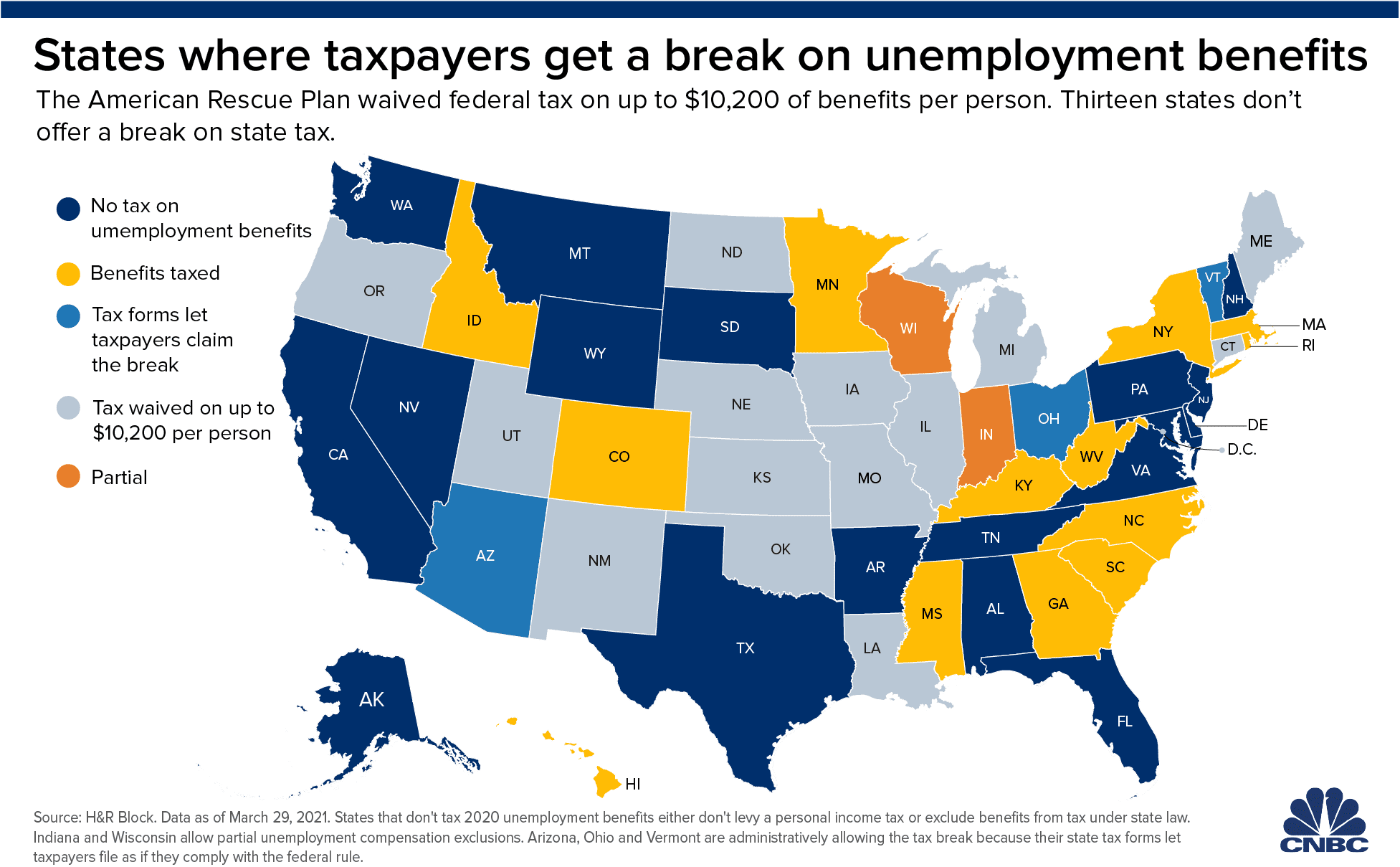

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for. Jan 26 2022. However Congress did not pass a similar tax break law for 2021.

Unemployment compensation is nontaxable for state purposes. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. The IRS issues more than 9 out of 10 refunds in less than 21 days.

If you qualify for a bigger tax refund youll receive it beginning August 2021. That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. Last year around 25 million people in the US collected unemployment benefits according to Andrew Stettner.

If you lost a job in 2020 and received unemployment benefits to make ends meet Congress this month approved a tax break for you. The IRS is set to refund unemployment tax. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in 2020.

Thankfully the IRS has a. Married filing jointly. Visit Instructions for Schedule CA 540 7.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. California will make the required changes. Recipients may not get a tax break this year which means they should take.

These will start going out in June and continue through the summer. The tax break is only for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during the pandemic in 2020. Most should receive them within 21 days of when they file electronically if they choose direct deposit.

The start of tax season has finally arrived. As such many missed out on claiming that unemployment tax break. The law allows taxpayers to exclude from income up.

In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect. These will start going out in June and continue through the summer. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Other taxpayers will receive refunds pursuant to normal return and refund. Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits. When to expect a refund for your 10200 unemployment tax break.

Your tax return will be processed with the updated requirements. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. Filed or will file your 2020 tax return after March 11 2021 and.

Its currently 750 until early september. Make a subtraction adjustment on the unemployment compensation line in column B of California Adjustments Residents Schedule CA 540 6. Sadly you cant track the cash in the way you can track other tax refunds.

You dont need to do anything. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. Another way is to check your tax transcript if you have an online account with the IRS.

But workers like Bryant and Morris didnt get paid till 2021 after the tax break expired. Stettner is an unemployment expert at The Century Foundation. Refunds should be hitting mail boxes and bank accounts however you normally receive tax refunds within the next couple of weeks.

Up to 10 cash back Taxpayers who filed for 2020 reporting unemployment income and claiming the CalEITC do not need to do anything. The tax break isnt available to those who earned 150000 or more. Refunds started going out the week of May 10 and will run through the summer as the IRS evaluates tax.

This could potentially be a surprise situation for taxpayers that thought the tax break carried over into 2021. The IRS will automatically refund money to. However unlike the previous years tax season there is no such cut available this year for those receiving unemployment benefits from the federal government.

The IRS has identified. We will make the changes for you. IRS tax refunds to start in May for 10200 unemployment tax break.

When Will Irs Send Unemployment Tax Refunds King5 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When Will Irs Send Unemployment Tax Refunds King5 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund California H R Block

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca